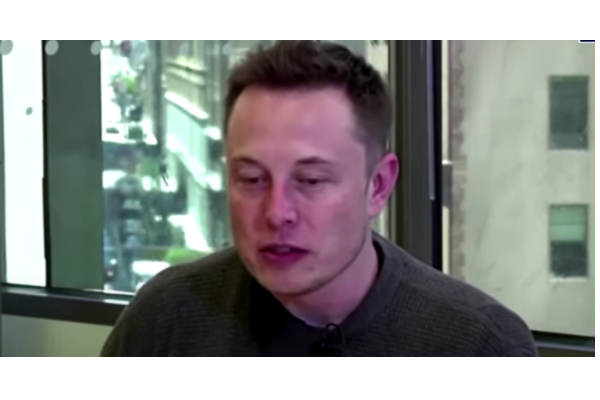

Tesla CEO Elon Musk Faces Legal Trouble for Late Disclosure of Twitter Holdings

In a significant move, the US Securities and Exchange Commission (SEC) has filed a lawsuit against Tesla CEO Elon Musk, accusing him of failing to disclose his substantial stake in Twitter within the required timeframe. The SEC alleges that Musk’s delay in disclosure allowed him to acquire shares at artificially low prices, saving him approximately $150 million (£123 million) in share purchases.

The issue stems from SEC regulations mandating that investors who acquire more than 5% of a company’s stock must disclose their holdings within 10 days of surpassing that threshold. According to the lawsuit, Musk disclosed his holdings 21 days after crossing the 5% mark, a delay that allegedly created an unfair advantage in the market.

The SEC claims that Musk’s delayed disclosure prevented the market from responding to his large-scale purchase in real-time. “Investors depend on timely and accurate information when making decisions. A delayed disclosure undermines market transparency and integrity,” the SEC stated in its filing.

This development marks the latest chapter in Musk’s controversial and high-profile dealings with Twitter. Musk, who acquired the social media platform in late 2022, has been at the center of debates regarding his management style, including decisions related to content moderation and corporate restructuring.

Musk has not yet issued a formal response to the lawsuit. However, the case adds to his ongoing legal entanglements, as he has previously clashed with the SEC over tweets regarding Tesla’s stock prices and privatization plans.

Market analysts believe this lawsuit could have broader implications for regulatory oversight of high-profile investors and their market practices. While Musk’s supporters argue that his innovative ventures and disruptive strategies often draw unwarranted scrutiny, critics emphasize the importance of adhering to regulatory standards to ensure a level playing field for all investors.

The SEC is seeking penalties and restitution for the alleged $150 million in gains, along with additional measures to prevent future violations. The case will be closely watched by the financial community and could shape future enforcement of disclosure rules in the securities market.

As the lawsuit progresses, Musk’s influence and strategies in the financial world remain under the microscope, further cementing his status as one of the most polarizing figures in global business.